The Group will focus on managing gearing levels, executing expansion opportunities, broadening product range, balancing pricing and volume objectives, achieving growth of margin, managing operating costs in light of the environment and ensuring maximum free cash generation.

L E M Ngwerume, Board Chairperson

Axia Corporation Limited

Axia is an established retail and distribution enterprise that sells speciality homeware furniture and electrical appliances in its retail outlets across Zimbabwe. The company also retails automotive spares across multiple channels with a footprint that stretches to Zambia and Malawi.

Axia’s expertise lies in providing a reputable service for inbound clearing, bonded warehousing, ambient and chilled/frozen warehousing services, logistics, marketing, sales and merchandising services. The company leverages its nationwide retail footprint and regional reach to deliver quality products and services through three core business units:

- TV Sales & Home (TVSH)

- Transerv

- Distribution Group Africa (DGA)

Axia delisted from the Zimbabwe Stock Exchange on 28 February 2023 and listed on the Victoria Falls Securities Exchange on 3 March 2023.

Company Information

TVSH is Zimbabwe’s preeminent furniture and electronics retailer, with over 50 nationwide stores and a 50+year legacy. The company has vertically integrated operations comprising retail, manufacturing, and distribution arms. It owns top lounge suite maker Legend Lounge, has a significant shareholding in renowned bed manufacturer Restapedic Bedding, and owns distribution unit Touch Distributors to tap into rising homeware and appliance demand.

Leveraging long-standing supplier partnerships, a widespread footprint, and a diverse, quality product range across furniture, electronics, and home goods, the company solidifies its market dominance and drives growth by meeting evolving customer needs.

Transerv, a proudly Zimbabwean automotive brand established in 2002, has evolved into a retail powerhouse servicing customers nationwide.

The company’s comprehensive offering spans branded retail locations, fitment centres, and specialist automotive businesses, namely Transerve Clutch and Brake. Transerv leverages its multiple retail branches to deliver quality products and services in meeting the needs of its customers throughout Zimbabwe.

DGA, founded in 1999, is a leading distribution company across Zimbabwe, Zambia, and Malawi. Its exclusive relationships with renowned brands like Colgate, Johnson & Johnson, and Unilever allow the company to leverage world-class warehousing capabilities and a robust vehicle fleet.

DGA’s expertise spans inbound clearing, bonded warehousing, logistics, marketing, sales and merchandising services, facilitating the delivery of seamless distribution solutions for ambient and chilled/frozen products.

3 Reasons to Invest in Axia Corporation

Our Share Price in Action

Investor News

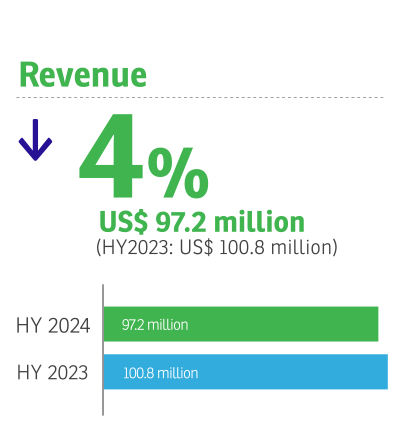

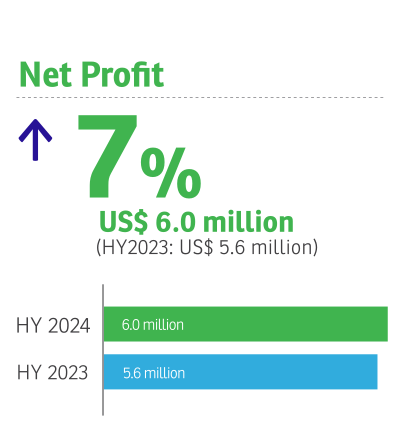

Axia Corporation – Unaudited Abridged Financial Results for HYE 31 December 2023

Chairman’s Statement and Review of Operations DIRECTORS’ RESPONSIBILITY The Directors of Axia Corporation Limited are responsible for the …

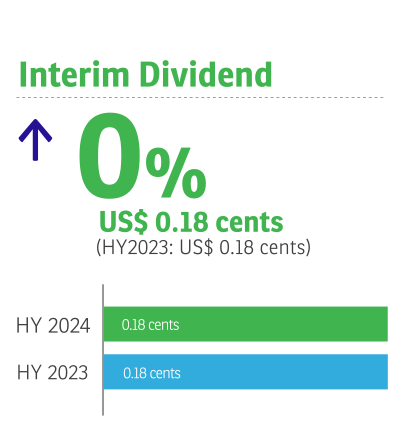

Axia Corporation declared an interim dividend of 0.18 US cents per share

Ordinary shares The Board has declared an interim dividend of US$0.0018 (0.18 US cents) per share in respect …

Axia Corporation appoints Simbarashe Mambanda as Group Finance Director

The Board of Axia Corporation Limited wishes to announce the appointment of the Group Finance Director, Mr. Simbarashe …

Axia Corporation – Results of the Eighth Annual General Meeting

At the Eighth Annual General Meeting of members held at the Royal Harare Golf Club Conference Room on …

Axia Corporation Limited – Trading Update for the first quarter ended 30 September 2023

Trading Environment Trading for the most part of the quarter was satisfactory as the operating environment was relatively …

Documents and Reports

Axia Corporation invites you to review its latest published financial reports: half year reports, annual reports / reference documents. All the listed documents may also be downloaded for further perusal.

-

Zimbabwe : Retail

Axia Corporation Limited (AXIA.vx) HY2024 Interim Report

HY2024 Interim Reports -

Zimbabwe : Retail

Axia Corporation Limited (AXIA.vx) Q12024 Interim Report

Q12024 Interim Reports -

Zimbabwe : Retail

Axia Corporation Limited (AXIA.vx) 2023 Annual Report

2023 Annual Reports -

Zimbabwe : Retail

Axia Corporation Limited (AXIA.vx) 2023 Abridged Report

2023 Abridged Reports -

Zimbabwe : Retail

Axia Corporation Limited (AXIA.vx) Q32023 Interim Report

Q32023 Interim Reports -

Zimbabwe : Retail

Axia Corporation Limited (AXIA.vx) HY2023 Interim Report

HY2023 Interim Reports -

Zimbabwe : Retail

Axia Corporation Limited (AXIA.vx) 2022 Circular

2022 Circulars -

Zimbabwe : Retail

Axia Corporation Limited (AXIA.vx) 2022 Annual Report

2022 Annual Reports -

Zimbabwe : Retail

Axia Corporation Limited (AXIA.vx) Q12023 Interim Report

Q12023 Interim Reports -

Zimbabwe : Retail

Axia Corporation Limited (AXIA.vx) 2022 Abridged Report

FY2022 Abridged Reports

Financial Summary

The facts that affect Axia Corporation’s underlying value.

(All values displayed below are in US$ except where indicated otherwise)

| 30 Jun 2023 | 30 Jun 2022 | |

|---|---|---|

| Revenue | 203,749,965 | 204,181,128 |

| Attributable PAT | 3,759,927 | 5,619,135 |

| Shareholders Funds | 34,180,546 | 30,956,735 |

| Net Interest Bearing Debt | 22,874,066 | 6,833,365 |

| Cash On Hand | 2,839,285 | 5,723,036 |

| Interest Bearing Debt | 25,713,351 | 12,556,401 |

| Net Current Assets | 29,296,555 | 33,121,799 |

Corporate Governance

Axia Corporation Limited is committed to upholding the principles of Corporate Governance as outlined in IS134 of 2019 Securities and Exchange Rules (Victoria Falls Stock Exchange Listing requirement), the Companies and Other Businesses Entities Act (Chapter 24:31), the King IV Code, the National Code on Corporate Governance in Zimbabwe and other International Best Practices on Corporate Governances. The Directors recognise the importance of conducting the Group’s affairs with transparency, integrity, accountability, and abiding with accepted corporate practices. This approach assures shareholders and other stakeholders that Axia Corporation is being managed ethically with prudently determined risk parameters and in compliance with the best international practices. This ensures value addition to the Group’s financial and human capital investment.

Board Committees

In line with good corporate governance, the Board has well established committees to assist in carrying out its duties. At present there are four committees, being Audit and Risk, Remuneration, Nomination and Executive. The composition and responsibilities are outlined below:

Executive

The Executive Committee is responsible for formulating, directing, and implementing strategic decisions. The Committee meets monthly and comprises two Directors and five executives from business units.

Members: R. Rambanapasi, S. Mambanda, L. Mugabe, S. Gorringe, J. Kamasho, C. Hodgson, L. Makwasha

Audit and Risk

The audit and risk committee of the Board deals, inter alia, with compliance, internal control and risk management. The committee currently comprises two independent non-executive directors and one executive director.

The committee meets at least three times a year and its responsibilities include but not limited to the following:

-

- Ensuring that financial reporting across the Group is transparent, accurate and reliable;

- Overseeing and managing the performance, functioning, and effectiveness of the organisation’s finance and risk functions and internal audit functions;

- Assisting the Board in fulfilling its corporate governance oversight responsibility regarding the identification, evaluation, and mitigation of operational, strategic, and external risks;

- Monitoring and reviewing the organisation’s risk management practices and risk related disclosures and;

Ensuring that the roles and functions of both internal and external audit are lucid and synchronised. Both the internal and external auditors meet regularly and have unrestricted access to the Audit Committee

Members: T.N. Sibanda (Chairman), T.C. Mazingi, R.M. Rambanapasi, S. Mambanda

Remuneration and Nomination

The remuneration and nomination committee comprises three independent non-executive Directors, one non-independent non-executive Director, and one executive Director. The remuneration and nomination committee’s mandate has the following primary responsibilities.

- Evaluating and sanctioning the appointment of, and remuneration packages for, all Board members, Executive Directors, and senior management. In doing so, it will assemble a structure and strategy related to the terms of employment for employees, management, and board members, as well as any compensation that aims to reward in a manner that attracts and retains talented individuals, and employees to constantly seek to elevate and contribute to the Group’s success.

- Orchestrating succession planning within the Group, particularly that of the chief executive and executive management.

Criteria for Nomination

The Board is key to the Group’s long-term success and ensuring strong leadership is paramount. The Group strives to make sure that there is the right calibre of leadership at the top levels thus selection of board members considers diversity, independence and expertise, with due consideration of the business stakeholders.

Members: T.C. Mazingi (Chairperson), L.E.M. Ngwerume, Z. Koudounaris, T.N. Sibanda, R.M. Rambanapasi

Board Responsibility

The Board’s primary responsibility is to fulfill its fiduciary obligation to the shareholders and the Group. As such, it serves as the highest policy-making entity of the business and is responsible for providing strategic guidance. The Board meets quarterly to oversee management performance and uphold control over the Group’s strategic direction.

Board Composition

The Board comprises one executive director and four non-executive directors, three of whom are independent. Non-executive Directors provide independent guidance and oversight for the Company’s strategic decision-making process and corporate governance practices.

Board Expertise

The Directors are allocated responsibilities in sub-committees where each member is assigned responsibilities based on their skills and area of expertise. Each business unit within the Group has a separate Board that is responsible for its day-to-day operations and has defined objectives. A comprehensive financial reporting system is in place to ensure that each business unit is held accountable on a monthly basis.

Nomination of Directors

The Board comprises individuals with demonstrated track records and diverse skills and experience, which they leverage for the benefit of the Group. The Group is committed to ensuring that there is top-notch leadership at the highest level. Therefore, the selection of board members considers diversity, independence, and expertise, while paying attention to the interests of the business stakeholders.

Ray Rambanapasi - Axia Group Chief Executive Officer

Simbarashe Mambanda - Axia Group Finance Director

Sean Gorringe - TV Sales & Home Managing Director

Joseph Kamasho - TV Sales & Home Finance Director

Craig Hodgson - Distribution Group Africa Managing Director

Lucille Makwasha - Distribution Group Africa Finance Director

Lloyd Mugabe - Transerv Managing Director

Faith Manikai - Transerv Finance Manager

Seko Mwanyungwi - Distribution Group Africa Zambia Managing Director

Priscilla Mwanza - Distribution Group Africa Zambia Head of Finance

Kennedy Muchenga - Distribution Group Africa Malawi Managing Director

Mathew Shonhiwa - Distribution Group Africa Malawi Finance Manager